Beste Kliënt

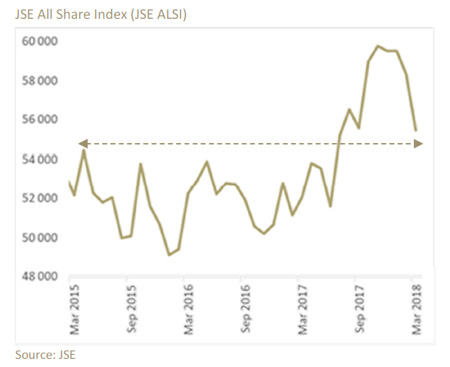

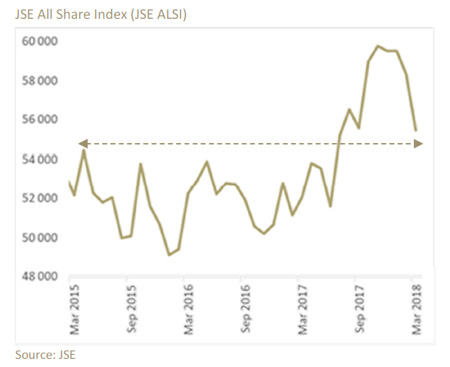

Daar heers onsekerheid en onrustigheid by etlike beleggers oor die korreksie op die aandelemark sedert laat 2017. Sommige meen dat eibeleggings hulle in die steek laat en dat gemoedsrus gesoek moet word deur beleggingsportefeuljes daadwerklik aan te pas. Dis verstaanbaar. Die onderstaande grafiek toon dat die JSE-indeks van alle aandele (JSE ALSI) sedert laat 2016 skerp gestyg het, voor die daling van ongeveer 10% sedert die ALSI se onlangse hoogtepunt.

Die VSA se belangrikste aandeelprysindekse toon soortgelyke korreksies nadat rekordhoogtepunte herhaaldelik bereik is. Beleggers se geesdrif het daartoe bygedra dat aandelewaardasies te hoog gedryf is. Toe markdeelnemers dit besef, het dit gelei tot sterk verkoopaksie oor die kort termyn, ook van topklas aandele.

Toonaangewende aandele soos Naspers, Sasol, Richemont en British American Tobacco het oor hierdie termyn wesenlike prysdalings getoon. Is drastiese optrede nodig en, indien wel, wat is die aangewese benadering? Dis noodsaaklik om rustig te besin eerder as om toe te laat dat betreklik kortstondige gebeure gemoedsrus versteur en emosionele aksie veroorsaak.

Suksesvolle beleggers wat talle beleggingsiklusse beleef en oorleef het, behaal beleggingsukses deur harde dissipline toe te pas. Dit sluit die volgende in:

- toon geduld, d.w.s. moenie kort-kort in en uit die mark en/of effektetrustbeleggings skuif suiwer op grond van teleurstellende korttermynprestasie nie

- beoordeel beleggingsprestasie oor die lang termyn; dit verskaf beleggingsgemoedsrus

- volg ’n deeglik voorbereide beleggingsplan, gegrond op sinvolle risikodiversifikasie (d.w.s. die gepaste mengsel van bateklasse en aandelekeuses), met duidelikheid oor behoeftes en bestendige beleggingsbestuur in ooreenstemming met die plan

- hou by u beleggingsplan indien u situasie nie drasties verander nie, al betree die beleggingsiklus daalfases

- fokus op gehaltemaatskappye se aandele en kwaliteitbatebestuurders se effektetrusts

- erken en aanvaar dat marksiklusse bestaan en dat gehaltemaatskappye se benadering ook negatief geraak kan word wanneer saketoestande knyp en sentiment verswak; hulle beskik egter meestal oor topgehalte bestuur, sterk balansstate en goeie sakevernuf en - ondervinding wat langtermynsukses en -oorlewing binne hulle bereik hou

- gebruik betroubare beleggingsnavorsing en besluitnemingsinligting

- behou noue, deurlopende kontak met u beleggingsbestuurder en volle vertroue in die gehalte van hierdie verhouding en die advies wat gegee word

Ons verseker u graag van ons begrip wanneer onsekerhede u pla. Ons grootste professionele vernuf is vervat in die opstel en implementering van u beleggingsplan. Die advies wat ons aanbied, word deur globale beleggingsinsigte en - ondervinding onderskryf. Ons is deurgaans toegewy aan u belange. Ons moedig u aan om rustig saam met ons oor u beleggingsbelange te besin en daardeur gemoedsrus te kry.

Laat ons die uitdagings van hierdie onsekere tye saam aanpak.

Vriendelike groete

Hannes en span

PSG Hermanus Portefeuljebestuur en Aandelemakelary

Heavyweights such as Naspers, Sasol, Richemont and British American Tobacco also suffered substantial share price declines. Are drastic measures necessary, and if so, what is the appropriate way to address this? Calm reflection is essential, instead of being carried away by relatively short-term events triggering an emotional response.

Heavyweights such as Naspers, Sasol, Richemont and British American Tobacco also suffered substantial share price declines. Are drastic measures necessary, and if so, what is the appropriate way to address this? Calm reflection is essential, instead of being carried away by relatively short-term events triggering an emotional response. Toonaangewende aandele soos Naspers, Sasol, Richemont en British American Tobacco het oor hierdie termyn wesenlike prysdalings getoon. Is drastiese optrede nodig en, indien wel, wat is die aangewese benadering? Dis noodsaaklik om rustig te besin eerder as om toe te laat dat betreklik kortstondige gebeure gemoedsrus versteur en emosionele aksie veroorsaak.

Toonaangewende aandele soos Naspers, Sasol, Richemont en British American Tobacco het oor hierdie termyn wesenlike prysdalings getoon. Is drastiese optrede nodig en, indien wel, wat is die aangewese benadering? Dis noodsaaklik om rustig te besin eerder as om toe te laat dat betreklik kortstondige gebeure gemoedsrus versteur en emosionele aksie veroorsaak.