Retirement Matters | Government Pension Reform

Funding your retirement, the management of assets purchased and the retirement product used, will determine the amount of money available to you at retirement and the income you can receive. I recently met with a client, ‘Angela’. She was extremely concerned about her retirement prospects and had never performed an in depth cash flow analysis of what she might receive at retirement as an income. The previous financial advisor had placed her in cash related funds with 20 years to retirement. If only she had placed the monies in a balanced fund, she would now have 4 times the amount for retirement. Angela’s story is unfortunately the same one we come across with most new clients. The Government’s Pension Reform Plan, aims to address inappropriate retirement advice and enforce legislation which will offer you the client a greater level of security at retirement.

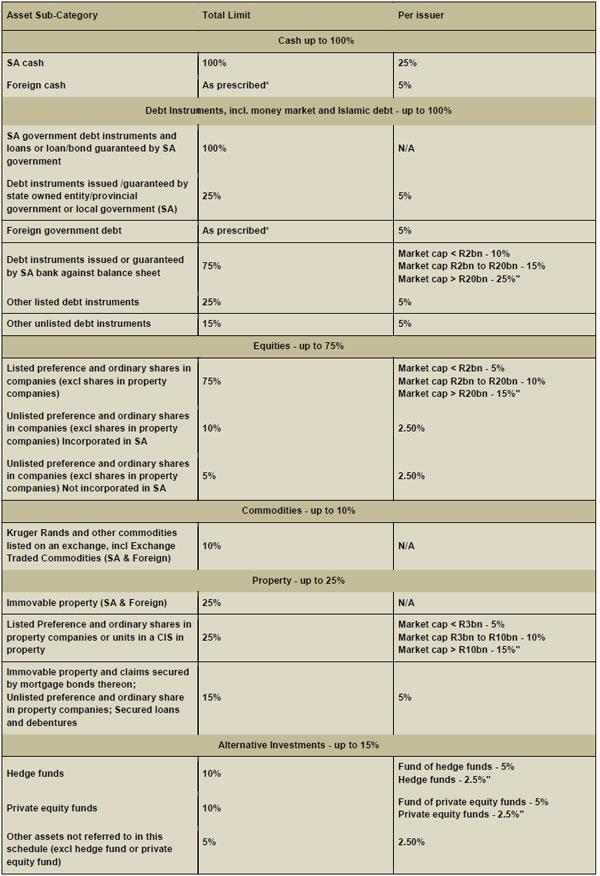

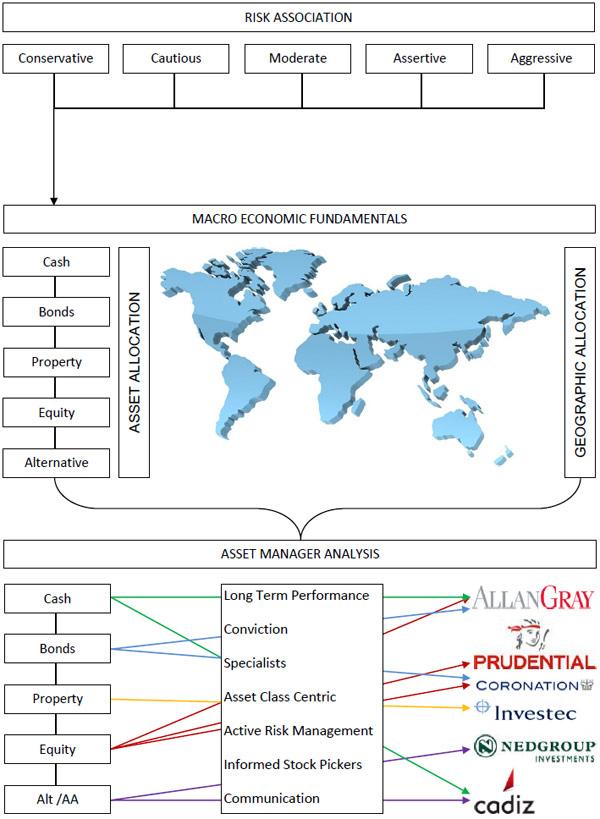

One of the ways in which legislation has changed to protect your retirement lump sum is to decrease the amount of exposure allowed to certain riskier assets. This legislation is dealt with in Regulation 28 of the Pension Funds Act, otherwise known as the Prudential Investment Guidelines. The table at the end of the news letter illustrates the restrictions imposed. These restrictions make it extremely difficult for the average financial advisor to choose appropriate funds relative to a client’s risk propensity and term to retirement. We have thus discovered most Financial Advisors putting clients into Balanced funds only. This defeats the purpose of sound investor advice as certain asset managers are specialists in managing specific assets. With the advent of the new Regulation 28 enforcement, Financial Associates, with the assistance of various asset managers have re-engineered the allocation to portfolios whilst retaining our house view on fund managers, asset classes and Geographical positioning. We follow an extremely rigorous due diligence process, as can be seen below, and use various risk assessment models to achieve the most efficient risk adjusted performance.

Financial Associates Risk Adjusted Asset & Fund Manager Allocation

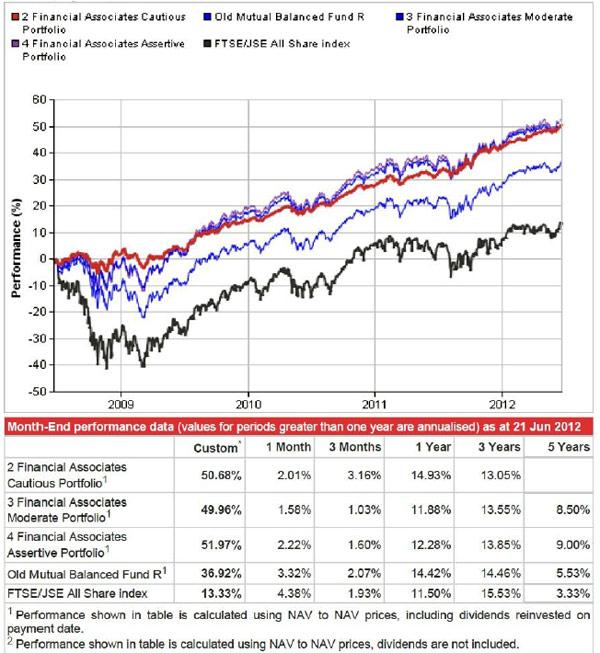

Portfolio Comparison - Performance

Graph showing total return (%) from 23 June 2008 to 21 June 2012

Most noticeable is the risk aversion employed by our strategy during the Market Crash of 2009. The net resultant is the subsequent upside you receive through our risk adjusted House View. By extension an average balanced fund underperformed all our regulation 28 combinations by a significant margin. I have attached the Regulation 28 Legislation as an indication of the complexity.