- INTERPRETING AND FILTERING

- FROM THE “BOILER ROOM”

- LEGAL CORNER

- WELCOME

Interpreting and Filtering

Ratings Downgrade

Recently, Fitch Ratings downgraded South Africa’s long-term foreign and local currency Issuer Default Ratings outlook to negative. They did however retain the actual rating unchanged at BBB (for foreign currency) and BBB+ (for local currency).

This decision was expected by most analysts as GDP growth is down significantly mainly due to the Platinum and other strikes creating high wage demands and it will not be possible to correct this in 2014.

Other factors contributing to the downgrade include:

- Fiscal imbalance and the inability to achieve sustainable growth with increased social spending

- South Africa remains uncompetitive despite the sharp weakness in the Rand

- Large current account deficit

- Unemployment remains high

- Inability to reduce the budget

Historically it was easy to hide behind global economic circumstances; however the current economic state of the nation can mostly be attributed to the South African Government based either on certain bad policy or an inability to implement good policy efficiently and effectively.

Growing governance and corruption concerns do not bode well for the country either.

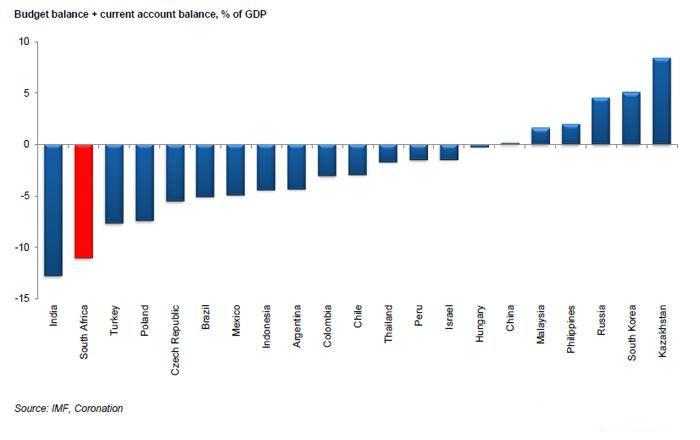

South Africa is however not the only emerging market to be facing severe headwinds. See graph below.

There are some positive factors to consider. South Africa is mainly financed domestically at roughly 85% to 90%. This minimizes currency risk. In addition, the term of these loans are medium to long, thus reducing financing risk. Our banks also boast significant capital reserves providing certainty.

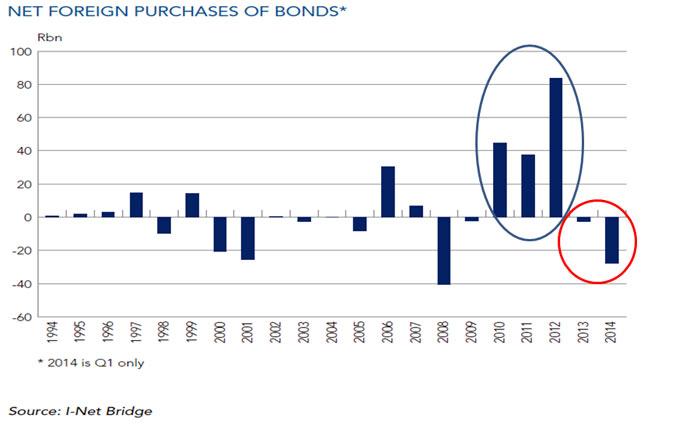

The underlying graph provides a sense of how foreign investors react when the risk to yield spread narrows. The US Federal decision to reduce tapering further squeezed risk appetite.

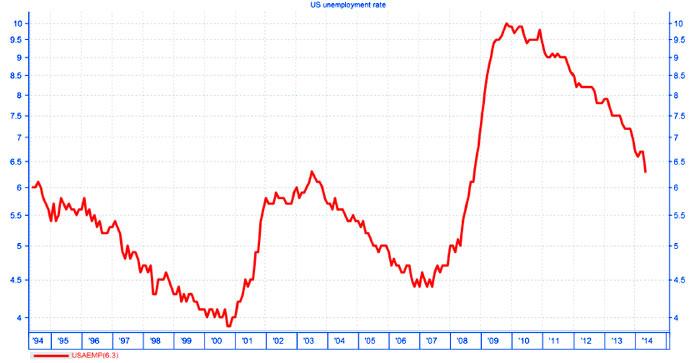

It must be noted that most of the larger developed nations have positive leading indicators. The following provides the US unemployment rates.

Where to from here? The data we have at the moment is priced into the markets. We have enjoyed a substantial bull market over the last few years driven mainly by the large blue chip shares. This movement of the large cap shares has driven the All share index to record highs and higher than average price to earnings ratios. Mid cap and small cap shares have severely lagged the large caps. Holding mid and small cap stock reduces downside risk as they carry a lower purchase price to the relative earnings. Your portfolio will include a few stocks which receive a large portion of their income from other countries, thereby further reducing risk. Some stocks which rallied since the 2008 crash have de-rated somewhat and now also offer good value.

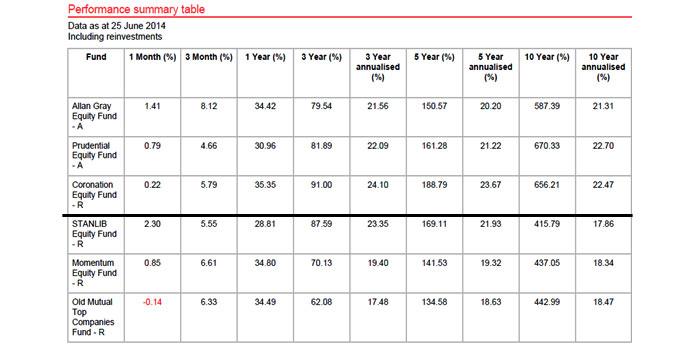

With the knowledge that the only exact science is hindsight, we understand that the secret to a good investment is to find great companies at a discounted price. It is for this reason that our three chosen Equity managers do not follow the pack, but are rather contrarian in their approach. The underlying comparison speaks volumes. There is at least a 130% out-performance over a 10 year period compared to a few managers “you just might know” within the General Equity classification.

From the Boiler Room

Most car magazines today offer a topical column which is related to certain experiences with clients, which had to be dealt with in a very diplomatic manner. Whilst most of these articles are amusing, it does provide insight into the mind-set variation within a client base. Unlike the car magazines we certainly do not find any facet of investing amusing, but rather use the insight we gather to equip our clients with a better understanding of the investment vehicles, instruments and assets, we use to grow wealth. By doing so, we believe we empower our clients to discard emotional reactions, decipher facts from all the noise and stay the intended course.

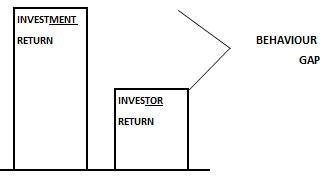

Behaviour Gap

| As a client of Financial Associates this sketch is probably familiar to you. It is illustrated for two reasons. It provides an understanding based on experience throughout the industry of the way in which most investors change their investment expectations when things are going well. It also reminds us to maintain the initial fundamental investment objectives throughout the term attributed to a specific investment. |

|

||||||||||||||||||

|

Financial Associates views each specific goal as a separate investment requirement. Each has an attributed term consideration, and asset class exposure for the investment’s ultimate purpose. We have on occasion highlighted a probable scenario with an understanding of the prevailing market conditions and by extension maintain a realistic view. |

We continue to caution against setting your expectations too high. Any out-performance would off course be a bonus and assist you at retirement or post retirement. If you expect to retire in 5 years’ time, it would be unwise to base your expectations on 16% per annum. This implies you taking on an aggressive portfolio, whereas your time horizon is only five years thus indicating a moderate investment strategy. With all these factors considered, we caution against stepping outside any mandate, or relying on past performance as your benchmark.

Consistency within a mandate delivers expected relative returns, thereby allowing you to achieve you goals and it often provides unexpected upside. Chasing performance usually always provides expected downside.

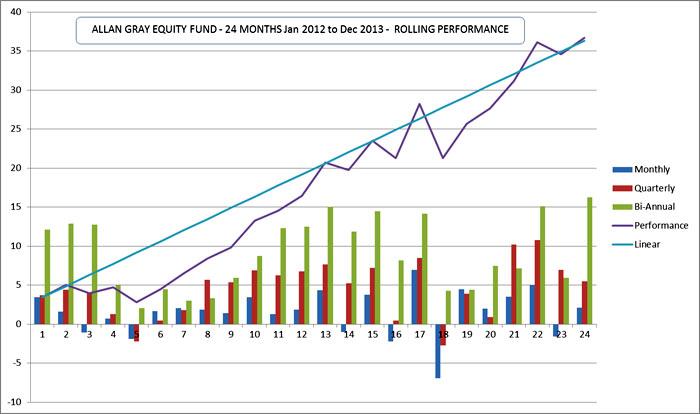

The above illustrated graph indicates various rolling periods for the Allan Gray Equity Fund. Monthly – offers insight to the performance per month over a two year period as indicated.

Quarterly – provides 3 months of performance on a rolling average

Bi-Annual – provides 6 months of performance on a rolling average

Performance - indicates the nominal performance

Linear – the straight line of all the performances

What is of great importance is the downside over the periods, bearing in mind that we have experienced a prolonged bull market. Monthly over two years there were 6 negative months. 25% of months were therefore negative. Much the same picture appears on a quarterly basis of 25%, however over 6 months there are no negative scenarios. This can be extrapolated to as much as ten years; however it provides the same fundamental lessons. Investing requires patience, and returns are relative to the associated risk over an appropriate term. The linear return illustration is in place to remind us that volatility is very real in the investment world, however time is the leveler.

Legal Corner

Reality Check – Are your affairs in place?

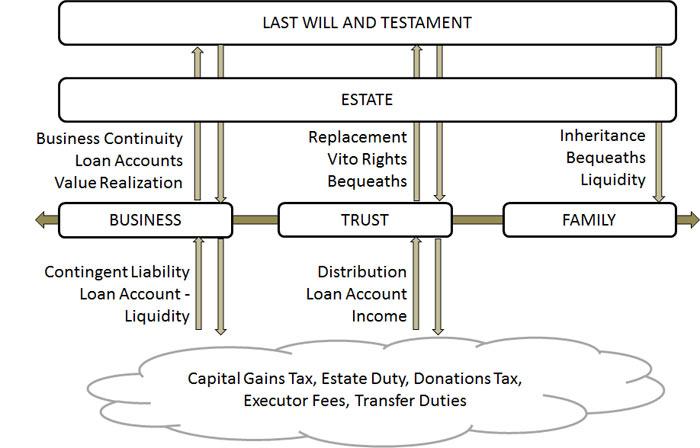

Part of the services offered by Financial Associates is the assistance of our client’s or their families when a loved one passes. We have over the past 2 years experienced quite a few situations of estates which are not structured correctly or not structured at all. Many clients will delay putting the correct structure in place. Some clients have their will with one attorney, their trust with another and have a bank as their executor. Business owners do not see a need to provide agreements for business continuity and by extension insurance for the value of their business to be paid to their estate. By not ensuring that all the entities in your portfolio are aligned correctly, both from a current tax and legal perspective; you risk leaving your bereaved family with untold difficulty.

We have therefor included legal aspects to this investor focus which will assist you to assess the implications of your current structure, the way in which your assets will be distributed and provide insight as to what your loved ones can expect.

Make sure your portfolio is correctly structured:

- Review your Will once a year.

- Ensure that your Will, Trust and Other entities are aligned and optimally structured, both for legal and tax purposes. It is often best to link your Attorney, Wealth Manager and Accountant. For optimal structuring, the tripod needs three legs.

- Do not use a bank as your executors. They always charge full price and you become ‘proverbially’ a number to them. They also use certain clauses which force you to invest the proceeds with them.

- Ensure that there is immediate cash available.

- Most Important – Ensure that at least one of your loved ones know the first steps should something happen.

In keeping with this theme, we have asked Elma Nieuwoudt from Finlego – Specialist Legal Services to provide some insight. Elma is an associate of Financial Associates, and besides providing general attorney services, specialises in the optimisation of the relationships between Estates, Trusts and other Entities.

Your Trust and Will – Do they dovetail?

When drafting your will, a trust is certainly the most beneficial tool to utilise for estate and tax planning as well as protection of assets. However, it might be of greater importance to address potential detrimental issues which might arise from omissions of certain aspects in your will, relating to your trust. In essence, when doing your estate planning, you have to ensure that existing trusts are aligned with your will. Herewith a few questions to address: Are you exercising the powers bestowed upon you in your trust deed for continuity of management of the trust or distribution of benefits, are all tax benefits utilised, are you contravening any trust terms or conditions with bequests in your will and are you taking care of the impact of loan accounts between your estate and trust?

Nominating successors:

Your trust deed might allow you to nominate people who will be your replacement trustee(s) in event of your death. This is usually done in your will and your trust deed may also allow for you to bestow a new trustee with certain powers that you might currently enjoy in your existing trust – usually in connection with voting or protection, not to be removed as a trustee. Failure to address this in your Will, means that you abdicate this power to other people, who will then decide upon the nomination of the new trustee(s). By this omission, you thus forfeit a right you have in terms of your trust deed, with potential dire consequence. You may also be bestowed with the power to nominate additional beneficiaries from certain classes or groups of people under certain circumstances; i.e. in the event of the current beneficiaries being pre-deceased, family obliteration or at termination of the trust. A usual default clause in event of family obliteration determines that all benefits be distributed to the Donor’s intestate heirs. Often this default clause provides that all trust benefits at termination will go to the deceased Donor’s residual heirs (nominated in the will) and therefore it is vitally important to ensure that the provisions of the will herein, aligns with your wishes. Verify the provisions in your trust deed and ensure it is addressed in the will or confirms that you prefer the default position that might be created in your trust deed.

Usufruct

In some wills, use is still made of usufruct, where a fixed asset (e.g. house) is bequeathed for example to the children or a trust, subject to the surviving spouse having life-long exclusive use of such asset (called a usufruct). Although there are still a few instances where it is recommended and suitable to provide for usufruct, great care must be taken in its use. Usufruct creates severe tax implications for the user of the right (e.g. the surviving spouse) in the form of deemed estate duty at their death as well as Capital Gains Tax consequence for the trust or children (the eventual owner of the asset) when they sell the asset in future.

Proper revision of the tax consequences must be done where there are current usufruct stipulations in a will and the use of usufruct must be done circumspect. There are alternate solutions to use in your will and trust, to get to the same effect of usufruct, without the dire tax consequence of the traditional usufruct created in existing wills.

Loan Accounts

Many trusts do not use their own money to buy trust assets and more often than not, there are loan accounts due by the trust to the trustees or beneficiaries. If you are such a trustee or beneficiary, you must pay attention to how these loan accounts are dealt with in your will. There are both tax and practical implications for your estate and the trust if it is not addressed correctly. The loan account is a deemed asset in your estate and at your death, should your will not address the issue, the executor of your estate must claim that money from the trust. If it is not your intention that the trust must repay the loan to your estate at your death, then it must be addressed properly in your will. Care must be taken on how it is done to achieve the desired effect from an estate administration point of view. It must be done in a way that fits in with other clauses in your will dealing with bequests to the trust or referring to the residue of your estate.

Bequeathing of Trust Assets

Take care to establish that assets bequeathed in your will, are indeed owned by your estate or are registered in your personal name (e.g. fixed property or vehicles) and is not the property of your trust. Assets in a trust are dealt with by the trustees of the trust and their discretionary decisions recorded in resolutions of the trust. There are circumstances where a client prefers or needs to determine what should happen to certain trust assets in event of their death. In such events, it should be done in the correct way and special care must be taken to avoid attracting unnecessary estate duty. Where a trust asset is bequeathed in a will, deemed estate duty will be charged on the value of the asset in the estate, nullifying the benefit of holding that asset in trust in the first place – to mention only one consequence thereof. Confirm ownership of assets before bequeathing it in your will.

Conclusion

If you have an existing trust, ensure that your will and the provisions of your trust deed are dove-tailed to express your personal wishes, utilise all tax benefits and ensure practical continuity in your trust.

Elma Nieuwoudt

Welcome

Financial Associates are very pleased to announce two new appointments.

If you are unsure of any of the above-mentioned factors, please contact Financial Associates as soon as possible.