The Minister of Finance announced amendments to tax and other legislation that may affect investors. These changes come into effect on 1 March 2018, unless otherwise indicated.

Income tax

Individuals and special trusts

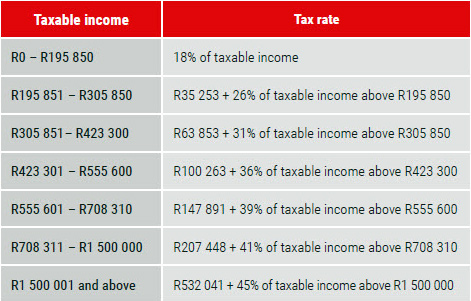

There were no adjustments to the top four income tax brackets and below inflation adjustments to the bottom three brackets. Taxpayers earning above R195 850 will now fall into the 26% tax bracket. The highest marginal tax rate for individual taxpayers remains unchanged at 45%. The personal income tax rates for the 2018/2019 tax year are listed below.

Companies and trusts

The income tax rate for companies remains unchanged at 28% and at 45% for trusts (other than special trusts).

Tax thresholds

Tax thresholds have increased to:

R78 150 for taxpayers younger than 65

R121 000 for taxpayers aged 65 to below 75

R135 300 for taxpayers aged 75 and older

Rebates

The primary, secondary and tertiary rebates (deductible from tax payable) were partially adjusted for inflation and have been increased to:

R14 067 per year for all individuals

R7 713 for taxpayers aged 65 and older

R2 574 for taxpayers aged 75 and older

Interest exemptions

The local interest exemptions remain unchanged:

The exemption on interest earned for individuals younger than 65 years remains R23 800 per annum.

The exemption for individuals 65 years and older remains R34 500 per annum.

Foreign interest remains fully taxable.

Medical tax credits

Below-inflation increases in medical tax credits will help government to fund the implementation of National Health Insurance. Monthly tax credits for medical scheme contributions will therefore only increase as follows:

From R303 to R310 per month per beneficiary for the first beneficiary

From R204 to R209 per month for each additional beneficiary

Dividends Withholding Tax (DWT)

Dividends withholding tax remains 20% on dividends paid by resident companies and by non-resident companies in respect of shares listed on the JSE.

Foreign dividends received by individuals from foreign companies (shareholding of less than 10% in the foreign company) are taxable at a maximum effective rate of 20%.

Interest Withholding Tax (IWT)

Interest withholding tax remains 15% on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Tax-free savings accounts

The annual cap on contributions to tax-free savings accounts remains at R33 000 with a life-time limit of R500 000.

Retirement lump sum taxation

At retirement

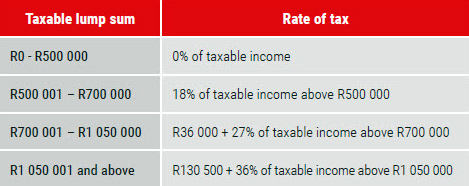

The first R500 000 of a retirement lump sum remains tax free. The table below illustrates how retirement lump sums will be taxed:

Pre-retirement

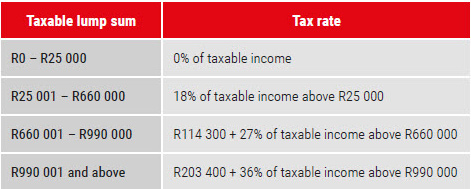

The first R25 000 of a pre-retirement lump sum withdrawal remains tax-free. The table below illustrates how withdrawal lump sums will be taxed:

Capital gains tax (CGT)

The capital gains tax inclusion rate for individuals and special trusts remains at 40%, and for other taxpayers at 80%.

The annual exclusion for a capital gain or loss granted to individuals and special trusts remains at R40 000.

Value-Added Tax (VAT)

VAT increases from 14% to 15% from 1 April 2018 on the supply of goods and services provided by registered vendors.

Estate duty

Estate duty is levied on property of residents and South African property of non-residents less allowable deductions. In line with the Davis Tax Committee recommendations and in keeping with the progressive structure of the tax system, estate duty has increased to 25%. The tax is levied on the dutiable value of an estate at a rate of 20% on the first R30 million and at a rate of 25% above R30 million.

Donations tax

Donations tax is levied at a flat rate of 20% on the value of property donated. To limit the staggering of donations to avoid the higher estate duty, any donations exceeding R30 million in one tax year will be taxed at a rate of 25%. The first R100 000 of property donated in each year by an individual is however exempt from donations tax.

Compiled by the Tax team, Allan Gray Proprietary Limited. Allan Gray Proprietary Limited is an authorised financial services provider. All information contained in this budget update is subject to legislation applicable at the time and is also subject to change. Allan Gra y is not authorised to and does not provide financial advice. All the information above should be regarded as guidelines only and should not be construed as advice.