In This Issue

Investment Vehicles at Retirement

Financial Associates – Downside Risk Management

Budget Tax Proposals – Relating to Financial Planning

Investment Vehicles at Retirement

Statistics show that most of our clients realise the importance of saving for retirement between the ages of 32 and 37. Whilst this is rather late in life, the critical aspect of this realization is to maintain a strong conviction of sticking to an aggressive retirement savings strategy. This usually takes gut determination for many decades and is ultimately extremely rewarding once achieved.

At retirement you will need to make a choice of the investment vehicles which will provide you with an income for the remainder of your life and hopefully leave some form of inheritance. Being creatures of instant gratification we tend to gravitate towards the products which provide us with the highest income, only to find that a few years down the line we cannot survive. So what products are available at retirement?

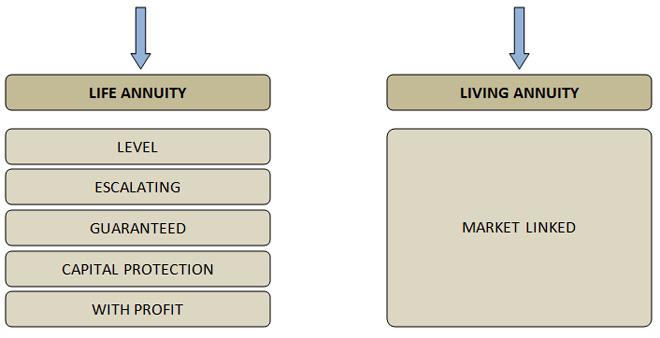

There is a choice of two paths which can be followed. The one binds you to an insurance company for the rest of your life and the other allows you to manage your risk, income, taxation and the legacy you would ultimately want to leave your loved ones.

What is a Life Annuity (also known as a Guaranteed Annuity)?

A Life Annuity is a product purchased from a Life Insurance Company which Guarantees you a certain amount of Income for the remainder of your life. If you are 55 at retirement you will receive less than a person of 65 as the Life Company calculates the Income on Mortality tables. At death the Life Company simply keeps your money that you invested. Most important is the fact that once you have purchased a Life Annuity, you cannot change your choice. You are in it for life. This is the very basic explanation as there are variations discussed below.

Types of Life Annuities

Level Annuity

The Life Company provides you with a fixed Income for the remainder of your life. It does however not take inflation into account. If you were receiving an income of R10 000 per month, within 10 years time the purchasing power of that R10 000 will only be worth R5 833, effectively inflation will halve your income within 10 years.

Escalating Annuity

As with the Level Annuity - The Life Company provides you with a fixed escalating Income for the remainder of your life, according your choice of escalation at inception. This level of income you receive at inception is considerably lower than the Level Annuity as the Life Company accounts for the escalations. The higher your choice of escalation, the lower the initial income will be.

Guarantee on Level and Escalating

A Guaranteed Annuity is actually an extension of the Level and Escalating Annuities. As mentioned, your income ceases at death, with both Level and Escalating Annuities. However, you may purchase a guarantee for five or ten years which will ensure that should you pass on within the guarantee period, The Life Insurance Company will continue to pay your beneficiaries for the remainder of the guarantee period only. Thereafter no further income is paid to the beneficiaries and the Life Company retains your funds. This option further reduces your initial Income.

Capital Protection

In addition to the above mentioned Annuities you can purchase a Protection Policy which ensures that a specified amount is paid out as a lump sum at your death. These are extremely expensive products as the income from the annuity funds a life policy to pay out the lump sum. Your Initial income could be as low as 3% per annum of your capital amount. This product is also fixed for life.

With Profit Annuity

This product offers a varying annual increase, which is linked to a smooth bonus type fund. If the fund does well your investment could increase with more than inflation. If the fund does poorly your income will reduce accordingly. The unfortunate aspect of this product is the reliance on the asset management of one Life Company. If you take this product with Sanlam as an example, all your eggs are being managed by one asset manager and you do not receive any form of tactical and strategic differentiation.

What is a Living Annuity (also known as a Market Linked Annuity)?

A Living Annuity is a product offered by Linked Investment Service Providers such as Allan Gray and Glacier. It offers complete flexibility of Income, underlying Asset Managers, Funds, Geographical Exposure, Assets, and a range of varying Strategies.

This product allows for a monthly income of between 2.5% and 17.5% per annum. The income received, unlike the Life Annuities mentioned above, can change on an annual basis according to your needs. The lower the income you take at any given time allows for more growth and longevity. The idea behind a Living Annuity is one of Perpetuity, thereby providing for your beneficiaries once you have passed on. At death the fund value can be paid out to your beneficiaries or your beneficiaries can choose to receive a regular income as per the criteria above.

Be aware that the vast number of choices and assets available with this type of product should only be considered in consultation with Professional Investment Advisors. Financial Associates only advocate Living Annuities for the many advantages within the flexible structure. A living Annuity allows us to tailor make strategies for each client according to life expectancy, risk tolerance, tax obligations, and personal or family plans.

Financial Associates | Downside Risk Management

Markets are driven largely by investor sentiment. Financial Associates constantly monitor various risk models such as standard deviation, volatility and Sharpe Ratios to mention a few. Monitoring does not assist you until you are able to decipher the data and use the information to actively manage downside risk.

It is possible to have a view on the growth of an asset, however no-one is capable of managing the growth of an asset if they do not have management control and even then many global factors influence such growth. It is however possible to manage a portion of downside risk. This is achieved by using tactical asset allocation within a portfolio.

We often meet with new clients to review their existing portfolio. More often than not it is clear that no downside risk management has taken place and the existing Advisor has chosen funds based on past performance.

By actively managing downside risk you achieve a greater upside.

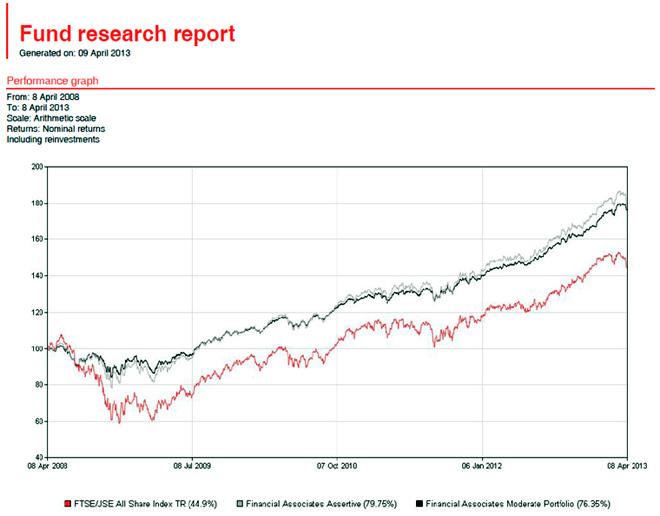

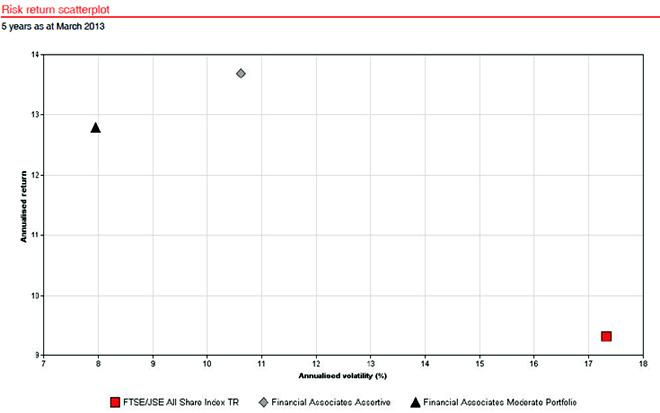

The underlying graphs confirm that our Assertive Strategy has outperformed the JSE with far less risk than the market. This holds true even for our Moderate Strategy which has outperformed the JSE with less than half of the risk.

Budget Tax Proposals | Relating to Financial Planning

Budget 2013 - Tax Proposals

The budget was read on 27 February 2013 and the following tax proposals were made. Please note that this summary is limited to proposals impacting financial planning.

1. Personal Income Tax Relief

The tax tables will be amended to result in personal tax relief of R7 billion. The primary rebate is increased from R11 440 to R12 080, the secondary rebate from R6 390 to R6 750 and the tertiary rebate from R2 130 to R2 250. This results in the annual tax threshold being as follows:

• Under 65 years – R67 111

• Over 65 years – R104 611

• Over 75 years – R117 111

2. Exemptions

The interest exemption has been increased to R23 800 for natural persons under 65 and up to R34 500 for those older than 65.

3. Medical Tax Credits

At this stage all taxpayers over 65 may claim all qualifying medical expenses incurred. Taxpayers under 65 may claim medical aid contributions as a tax credit against tax payable as follows:

• R242 per month (up from R230) for each of the taxpayer and the first dependant;

• R162 per month (up from R154) for each additional dependant.

In addition the taxpayer can claim a deduction for the aggregate of medical scheme contributions exceeding four times the amount of the medical Scheme fees tax credits and any other medical expenses, limited to an amount that exceeds 7.5% of the taxable income (excluding retirement fund lump sums). For taxpayers under 65 where the taxpayer or spouse or child is disabled, this last mentioned deduction is not capped.

Note – the Taxation Laws Amendment Act introduced medical tax credits for additional medical expenses which will be effective from 1 March 2014 (see ASAP on the Taxation Laws Amendment Act, 2012 for more detail).

4. National Health Insurance

Mention is made of the initial phase of the NHI Development, which will not place a new revenue demand on the fiscus. This phase has been initiated in ten districts and includes improvements to health facilities, contracting with general practitioners and financial management reforms.

Over the longer term it is anticipated that a tax increase will be needed and the funding systems are currently being examined.

5. Business Taxes

Small business corporations will enjoy an increased tax-free threshold from R63 556 to R67 111. Taxable income up to R365 000 (up from R350 000) will be taxed at 7%. A new bracket is being introduced for income between R365 001 and R550 000, which will be taxed at 21%. All income in excess of R550 000 will be taxed at 28%. This will be effective for the year of assessment ending on or after 1 April 2013.

6. Retirement Reform Proposals

A further consultation period, where comment is invited, will close on 31 May 2013. Draft legislation to give effect to the proposals will be published during 2013 after all comments are considered.

In the new proposals there is reference to two effective dates:

T-Day – Retirement Fund Contributions

T-day refers to the change in the treatment of retirement fund contributions and will be on or after 2015. On this day all employer retirement fund contributions will be included in the employee’s gross income as a fringe benefit. The employee will be entitled to a tax deduction for all contributions made to pension, provident or retirement annuity funds up to 27.5% of the greater of remuneration and taxable income (note the differentiation between the tax deduction applicable to taxpayers under the age of 45 and over 45 has been removed at this time). An overall ceiling of R350 000 will apply.

P-Day – Retirement Fund Preservation

P-day is the other relevant day which will change the rules of retirement fund preservation, which is also planned for 2015 or thereafter. After P-day all retirement funds will have to identify a preservation fund and the member’s funds will have to be transferred to the new employer’s pension or provident fund (where possible) or that preservation fund when they resign. Existing rules to preservation funds will be relaxed to allow for annual withdrawals, within certain limits. Payments resulting from divorce orders will also be transferred to these preservation funds.

After P-day there will also be new annuitisation rules in respect of provident funds. Full access will be restricted after this date. To limit the impact on provident fund members the minimum amount for full commutation will be increased from R75 000 to R150 000 (to apply at retirement).

Note that the fund value that accrued to a member prior to P-day will remain fully vested in the member and members that are older than 55 at the time will not be required to apply the new annuitisation rules.

Non-Retirement Savings

To encourage greater saving, tax-preferred savings and investment accounts are being proposed, which will encourage a new generation of savings products. Returns generated in these investments will be tax exempt and the withdrawals will also be free of tax. The design and costing of the products must ensure that lower income earners can also participate. Aggregate annual contributions could be limited to R30 000 per annum with a lifetime limit of R500 000 to ensure that high-earners to not benefit disproportionately.

The new accounts will be introduced in 2015 and it will co-exist with the current tax-exempt interest income dispensation.

7. Taxation of Trusts

The taxation of trusts will come under review to control abuse. Discretionary trusts should no longer act as a flow-through vehicle. Taxable income and loss (including capital gains and losses) should be fully calculated at trust level with distributions acting as deductible payments. Beneficiaries will be eligible to receive tax-free distributions except where it gives rise to deductible expenses. Trading trusts will also be taxed at entity level and distributions from offshore foundations will be treated as ordinary revenue.

8. Income Protection policies

A proposal is being made that all non-retirement fund disability and income-protection policies’ contributions will not be tax deductible and pay-outs will be tax exempt.