Investment Performance – Financial Associates

- The Rationale behind Reviews

- Re-balancing of Portfolios

- Looking Forward – What to expect from Local and Global Markets

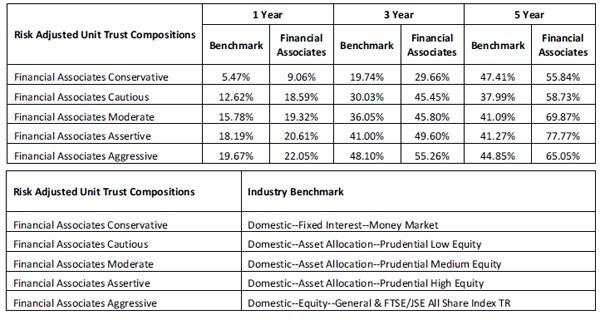

It is peculiar that when Humans become investors there is a change that exudes optimism. This phenomenon, the investment optimism bias (also known as unrealistic or comparative optimism) is a bias that causes a person to believe that they are less at risk of experiencing a negative investment event compared to others. The ideal world would have us believe that an aggressive investment will deliver greater returns than a conservative investment. This is true over the long term; however over periods of 1 to 5 years, cyclical trends can deviate significantly from expectations. It is imperative, when viewing the performance of any particular risk adjusted strategy, that the performance is viewed relative to a similar benchmark. This measure enables us to maintain objectivity and remove emotion from investment decisions. firm to our strategy through cyclical movements. This has enabled us to achieve significant performance for investors. Through our robust and extensive investment process, we have maintained significant alpha (out-performance), relative to our peers and comprehensively outperformed our benchmark.

The Rationale behind Reviews

Generating significant out performance during economic cycles requires regular assessment of macroeconomic fundamentals. Whilst reviews may only take place annually or bi-annually, the monitoring of Asset Manager behaviour, factors influencing asset classes and Global economic and political risk are details which affect your investment on a daily basis. Analysing and reacting to these factors ensure we have the ability to make informed changes to your portfolio when necessary.

Any changes to your personal circumstances require adjustments to the assets held, portfolio composition, income streams, applicable tax and legal structures and the entities within which your current structure vests.

Re-balancing of Portfolio's

A moderate portfolio consists of all the available asset classes. This includes the main asset classes of Cash, Bonds, Property and Equity. Our Financial Associates Asset Allocation House View for our Moderate Portfolio should contain between 30 and 50% Equity, 15% to 30% Cash, 15% to 30% Bonds, 5% to 15% Property, and 10% to 20% offshore exposure. Should one asset class significantly outperform another, the exposure to the other asset classes reduces. This could result in the portfolio being more or less aggressive than originally intended and by extension falling outside our intended risk rating. The figures below reflect the asset allocation of our moderate fund now in contrast to 3 years ago. The most significant shift can be seen in the gilt or bond exposure due to the interest rate cuts over this period, which shifted capital pricing.

Fund Research Resort

Generated on 15 August 2012

Looking Forward – What to expect from Local and Global Markets

Equity Local

The Euro Zone Crisis, slower than expected US recovery figures, growing fears of the extent to the slowdown in China’s GDP and increasing austerity measures globally, resulted in significant foreign

direct investment into South African Equities, Property and Bond markets as international investors are willing to take on more risk for higher yields. The valuations on our Equity Markets are thus rather high. Whilst our value asset managers can find pockets of value, expected growth is unlikely to match that of August 2011 to August 2012 as per this reporting period. With so much of our market being unprecedentedly supported by Foreign investors the downside risk to our markets is particularly high. It is thus important to re-balance the portfolios if need be.

Bonds and Fixed Interest Local

The recent interest rate cut to enhance stimulus to the economy took most of the market by surprise. Our average position was in the 5 year range and we therefore received a significant capital upside. We do however feel that rates are at the bottom of the cycle and will be very surprised with another rate cut. The duration to term of the assets held has therefore been reduced to make allowance for sideways or increased interest rates, which we foresee happening in the second quarter of next year.

Property Local

Property benefited significantly from the recent interest cut. Whilst at risk of capital depreciation within the next year should interest rates rise suddenly, we feel that capital exposure on Property

can be offset by the relatively good yields.

General Comment Global

The pessimistic sentiment globally is very evident in the US Bond Market where investors have driven bond yields to record lows of 1.5% per annum. If investors are happy to accept 1.5% to safeguard their money, it sends a very clear message that the global economic sentiment is one of extreme concern. For the first time in 10 years China is expecting growth of only 6% to 7%. Whilst other countries concern themselves over the impact to their trade and industries, our biggest concern is the downward pressure on metals and other commodities.

Conclusion

Local cash is currently offering no real return. Local bonds, whilst offering 1% to 1.5% real return, are rather risky within the current interest cycle. We have had an immense run on our local equities pushing valuations to the extreme on the expensive side. Property has also benefited from interest rate cuts but offer little further upside. The only assets offering significant value is undervalued companies in the global sector. Our asset allocation funds are well exposed to these assets, with most of them at their limit of allowed offshore exposure. We strongly advise against taking the previous year’s performance as a benchmark for the year to come.